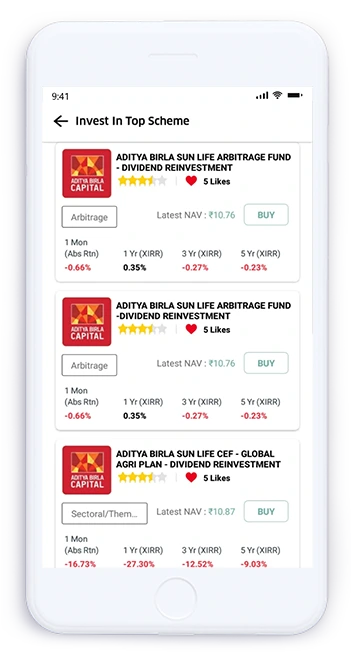

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

ABOUT Rawat Capital Building a Brighter financial Future & Good Support.

Welcome to Rawat Capital, your trusted financial companion in India. We understand that your financial journey is more than just numbers; it's a story of dreams, aspirations, and the legacy you want to leave behind. At Rawat Capital, we are driven by the belief that everyone deserves a secure and prosperous future.

Our journey began with a simple promise: to empower every individual in India to achieve their financial goals and protect what matters most. We know that life's uncertainties can be overwhelming, but with the right guidance and support, you can navigate them successfully.

Know More Services that we are providing

Services that we are providing

Mutual Fund

Investment pools combining funds from multiple investors to diversify portfolios in stocks, bonds, or other securities, managed by professionals.

Mutual Fund

Investment pools combining funds from multiple investors to diversify portfolios in stocks, bonds, or other securities, managed by professionals.

Insurance

A contract offering financial security to beneficiaries upon the policyholder's death, which ensures that their future needs are met.

Insurance

A contract offering financial security to beneficiaries upon the policyholder's death, which ensures that their future needs are met.

FD & Bonds

Fixed deposits are low-risk investments with fixed interest rates, while bonds are debt securities offering regular interest payments and return of principal.

FD & Bonds

Fixed deposits are low-risk investments with fixed interest rates, while bonds are debt securities offering regular interest payments and return of principal.

Tax Planning

The process of calculating and paying taxes to the government, ensuring compliance with tax laws and optimizing financial obligations.

Tax Planning

The process of calculating and paying taxes to the government, ensuring compliance with tax laws and optimizing financial obligations.

Equity

Welcome to the world of Equity investments, where financial growth meets opportunity. Investing in equities involves owning a portion of companies.

Equity

Welcome to the world of Equity investments, where financial growth meets opportunity. Investing in equities involves owning a portion of companies.

Loan

Borrowing money against financial assets or securities, providing liquidity without selling the assets.

Loan

Borrowing money against financial assets or securities, providing liquidity without selling the assets.

Buy Online

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Buy Online

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Pay Premium Online

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Pay Premium Online

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Online KYC

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Online KYC

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Financial Tools

Financial Tools

SIP Calculators

SIP Calculators

TRACK YOUR INVESTMENT AT ONE CLICK

TRACK YOUR INVESTMENT AT ONE CLICK

-

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.